Case Studies

“Success to our client and their business drives our success. Ensuring performance beyond expectations with our solutions.”

RPA Case Study – 1

A global insurance brokerage & risk management services company. The firm is one of the largest insurance brokers in the world.

Context

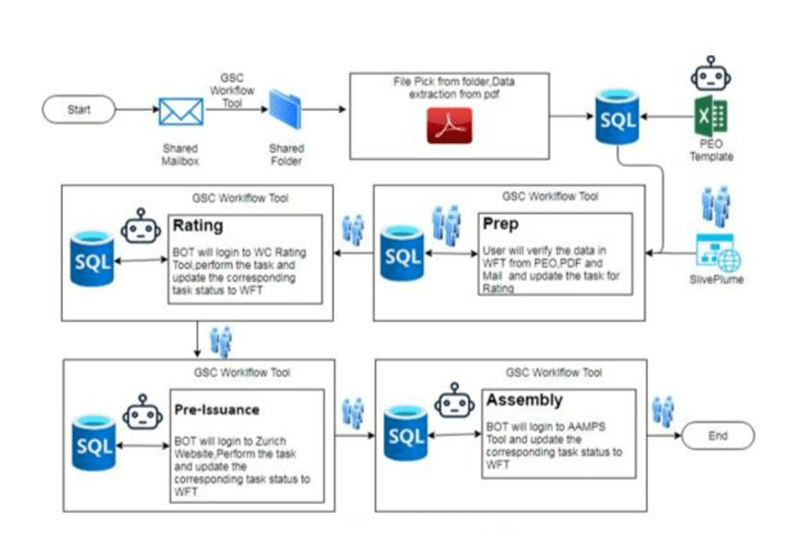

iBOTomate Solution

- The policy request sent by branches can be converted to PDF and worked upon by Prep bot to extract 67% of the fields needed (88 out of 131).

- Rating bot to rate policy for issuance.

- Policy issuance bot would perform a part of the policy issuance process.

- Assembly bot assembles the policy and update associated systems.

With multiple bots, human workers & multiple external systems, a workflow tool (WFT) helps orchestrate operations.

Value Adds & Benefits

- The solution is estimated to reduce headcount by ~60% (72 to 29) and reduce the processing time by 55% (110 minutes to 50 minutes).

- The solution will also provide intangible benefits such as process efficiency, predictability, and better utilization of human resources.

- Benefit through this project is realized in 4 months and with yields of ~USD 254,000 for the first year.

- Part of Powered Automation journey with the client with target of reducing ~2000 FTE by Dec 2022.

RPA Case Study – 2

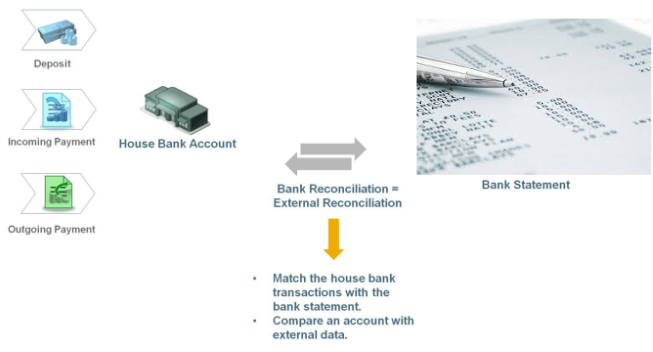

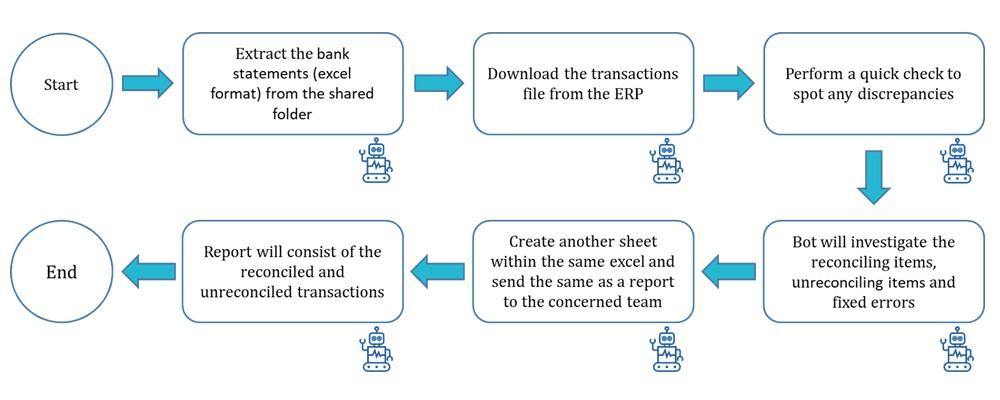

Objective is to significantly reduce the amount of time spent completing the daily repetitive Bank Reconciliation Process via Automation

Context

Data is consistent, digital, structured. The repetitive nature, evaluation and processing high volume of data in a short period of time makes it very suitable for RPA.

iBOTomate Solution

1) Auto-upload unreconciled bank transactions from core system and daily bank statements.

i. Extract the relevant documents and data including bank data files and register data files.

2) Execute transaction matching process.

i. Perform a quick check to spot any discrepancies.

ii. Data matched at the transaction level, and any discrepancies were identified.

iii. Investigate the reconciling items, and fixed errors.

3) Posting to the core system

i. Preparation of bank reconciliation statement & posting of adjustments.

ii. Once approved from the client team, the entries will be finalized, and updates will be closed.

Value Adds & Benefits

- Degree of robotization : ~90% of effort automated, easy to use & maintain set-up.

- Higher accuracy : Minimized error occurrence by reducing the error rate

- Better matching of records with fewer exceptions : Drastically reducing manual effort.

- Higher robustness : Faster average handling time and processing time.

- Better Standardization : Better and more reliable reporting.